8/27/2025 UPDATE:

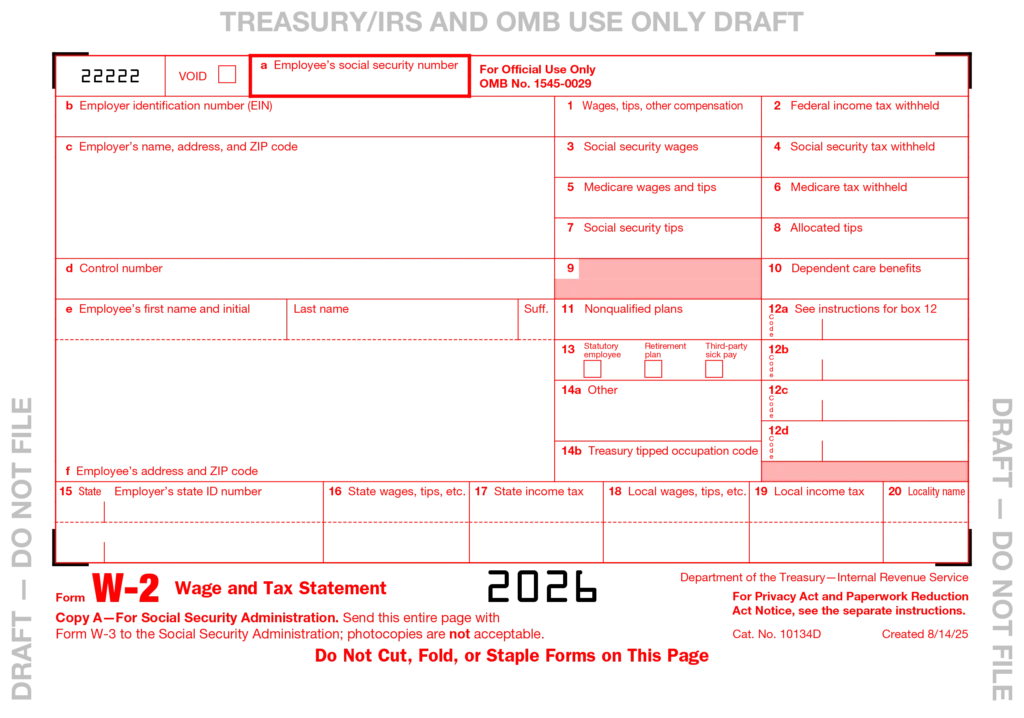

The IRS has released a new “early release draft” Form W-2 to reflect the new employee and employer reporting requirements related to “qualified tips” and “qualified overtime pay” that can be deducted, pursuant to the 2025 Trump Administration bill. The new Form W-2 instructions direct employers to use Box 12 to report the employee’s “qualified tips” using code “TP” and “qualified overtime compensation” using code “TT.” Further, the new form also includes a new Box 14b for employers to report the employee’s qualifying occupation (referred to as the “Treasury tipped occupation code”). See below for a snapshot of the new Form W-2. Employers should communicate with their payroll provider to ensure their systems will be updated to reflect the new reporting requirements and the ability to report on the new Form W-2 in time for Form W-2 distribution in January 2026. Please see below and this link to our August 12, 2025 blog which explains this issue more fully.

Originally published 8/12/2025:

In July 2025, the Trump Administration’s signature budget bill became law as Public Law 119-21. Of note for employers and employees, the bill permits tax deductions for “qualified tips” and a portion of overtime pay, as detailed in this IRS Fact Sheet.

Tax Deduction on Qualified Tips: Retroactive to January 1, 2025, and through 2028, employees and self-employed workers may deduct “qualified tips” that are received in the course of jobs that “customarily and regularly receive tips on or before December 31, 2024 and that are reported on Form W-2 by their employer, Form 1099 by the contracting company, or other tax reporting statement provided by the individual. To encourage employers to report all received tips, there is a requirement that employers must report the “qualified tips” on a Form W-2 or similar reporting form for employees to be able to deduct the tips. “Qualified tips” are those cash or charged tips received voluntarily from customers or through tip sharing; they do not include mandatory or preset tips for larger tables or service charges. The maximum annual deduction is $25,000 for employees and, for self-employed workers, may not exceed their net income from the work in which the tips were earned. The deduction phases out for taxpayers with a modified gross income over $150,000 ($300,000 for joint filers).

Tax Deduction on a Portion of Overtime Pay: Retroactive to January 1, 2025, and through 2028, individuals who receive “qualified overtime pay” may deduct the portion that exceeds their regular rate of pay as required by the Fair Labor Standards Act and that are reported on Form W-2 by their employer, Form 1099 by the contracting company, or other tax reporting statement provided by the individual. Thus, when an employee receives time-and-a-half for overtime, only the “half” portion may be deducted. Further, overtime pay not required under the FLSA, such as overtime required only by state law, an employee handbook policy, or a collective bargaining agreement may not be deducted. The maximum annual deduction is $12,500 ($25,000 for joint filers). The deduction phases out for taxpayers with a modified gross income over $150,000 ($300,000 for joint filers).

Employers are advised to consult with their payroll administrators to ensure that employee tips and overtime are adequately tracked and reported.

The attorneys and HR professionals at Lake Effect can provide guidance on employment-related executive actions, employment laws, regulations, and agency guidelines. We continue to monitor important legal and HR developments, as well as other information that could impact the workplace. Please watch our blogs and emails for these important updates, as well as discussions of how compliance meets culture. To dive into these issues, contact us at info@le-hrlaw.com or 1-844-333-5253.